Advice That Can Help Make You An Excellent Forex Trader

Forex is actually a shortened version of foreign exchange. This is a market where traders around the world trade one type of currency for others. As an example, an American trader previously bought Japanese yen, but now feels that the yen will become weaker than the dollar. If this is a good investment, this trader will be able to sell the yen for a profit later.

You need to know your currency pair well. Trying to learn everything at once will take you way too long, and you’ll never actually start trading. Consider the currency pair from all sides, including volatility. Break the different pairs down into sections and work on one at a time. Pick a pair, read up on them to understand the volatility of them in comparison to news and forecasting.

Try to avoid trading when the market is thin. Thin markets are markets that lack public attention.

Emotional moves, such as changing your stop-loss points, is a risky move that often results in greater losses. Following an established plan consistently is necessary for long-term success.

Do not compare yourself to another foreign exchange trader. Other traders will be sure to share their successes, but probably not their failures. Even a pro can be wrong with a trade. Stay away from other traders’ advice and stick with your plan and your interpretation of market signals.

People tend to be greedy and careless once they see success in their trading, which can result in losses down the road. Lack of confidence or panic can also generate losses. Make your decisions based on ration and logic, not emotion; doing otherwise may make you make mistakes.

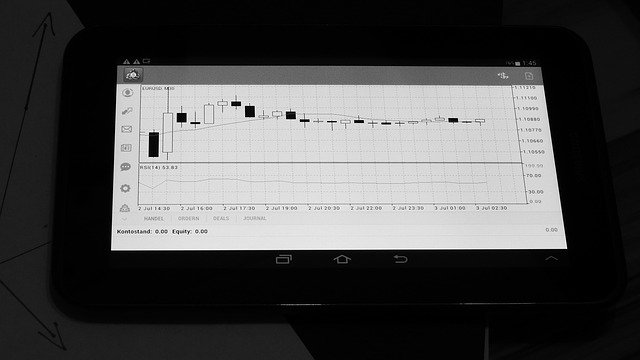

There are four-hour as well as daily charts that you need to take advantage of when doing any type of trading with the Foreign Exchange market. Technology makes tracking the market easier than ever, with charts in up to 15 minute intervals. However, short-term charts usually show random, often extreme fluctuations instead of providing insight on overall trends. Use lengthier cycles to avoid false excitement and useless stress.

Start Trading

Do everything you can to meet the goals you set out for yourself. If you make the decision to start trading foreign exchange, do your homework and set realistic goals that include a timetable for completion. Your goals should be very small and very practical when you first start trading. Determine how much time that you have each day to devote to trading and research.

Foreign Exchange trading is the largest global market. Only take this challenge is your are willing to do your homework, by becoming well informed about global markets and currency rates. The average trader, however, may not be able to rely on their own skills to make safe speculations about foreign currencies.