Amazing Ways To Get The Most From Your Foreign Exchange Plans

Some may pull back when they are thinking of investing in the forex market. It might seem difficult or overwhelming for the beginner. It’s good to be skeptical of something that can lose a lot of money. Educate yourself prior to investing. Keep up-to-date on relevant information. Here are some things that can help you!

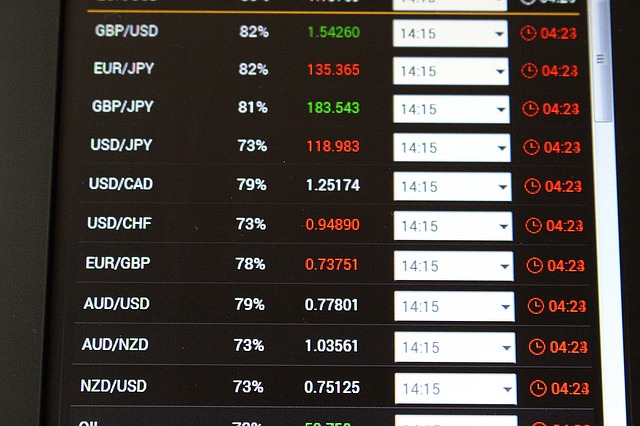

When trading on Foreign Exchange, you should look for the up and down patterns in the market, and see which one dominates. You will have no problem selling signals in an up market. Use your knowledge of market trends to fine-tune your trades.

Do not choose to put yourself in a position just because someone else is there. While you may hear much about that trader’s success, in most cases, you will not know about all their failures. Regardless of someone’s track record for successful trades, they could still give out faulty information or advice to others. Do not follow the lead of other traders, follow your plan.

Relying on forex robots can lead to undesirable results. These robots are able to make sellers a large profit, but the benefit to buyers is little to none. Do your own due diligence and research, and do not rely on scams that are targeted at the gullible.

Equity stop orders are something that traders utilize to minimize risks. It works by terminating a position if the total investment falls below a specified amount, predetermined by the trader as a percentage of the total.

Don’t try and get revenge if you lose money, and don’t overextend yourself when you have a good trading position. You must stay calm and collected when you are involved in foreign exchange trading or you will find yourself losing money.

Foreign Exchange is a business, not a game. Thrill seekers need not apply here. Their money would be better spent gambling at a casino.

Because the values of some currencies seem to gravitate to a price just below the prevailing stop loss markers, it appears that the marker must be visible to some people in the market itself. This is an incorrect assumption and the markers are actually essential in safe Forex trading.

Create a plan and stay on course. It can be wise to put a goal in place and a deadline for achieving it at the start of your foreign exchange career. If you’re a beginner, it’s best to keep in mind that you’ll probably make some mistakes along the way. Know the time you need for trading do your homework.

When trading foreign exchange, there are many important decisions to make. This is why lots of people are slow to begin. If you’re ready to start trading, or have already started, use the tips mentioned as a part of your strategy. Keep getting the most current knowledge available. Think about your options before you spend your money. Exercise intelligence when investing.