Stock Market Secrets: What You Need To Know

The simple paper you purchase when you invest in stocks are more than just paper. While you are a stock owner, you own a part of a company. Stocks entitle you to earnings and profits. In some cases, you can even vote in major elections regarding corporate leadership.

For the novice investor in the stock market, you should be aware that sometimes success is gained in the long term and not immediately. It can take awhile before some companies show any change in their stocks; thus, difficulty sets in for awhile before you can make any profit. Remaining patient is a skill you have to cultivate.

Give short selling a try. This is where you loan your shares out to other investors. This is when investors borrow shares through an agreement that will deliver the exact number of shares at a date that is later than normal. The investor sells the stock and buys it back after the price drops.

Recognize where your understanding ends and do not invest in companies which you do not fully understand. If you are making investments on your own, like when utilizing an online brokerage, stick to companies you already know about. While you might know how to judge a landlord, can you judge a company that makes oil rigs? Let a professional advise you on stocks from companies that you are unfamiliar with.

To make your stock portfolio better, create a plan including specific strategies. This should include when to buy or sell. It should also include a clearly defined budget for your investments. You will be making decisions with your head this way, instead of with your emotions.

Don’t invest too much into any company that you work for. A lot of employees are temped to invest in the company they work for, but this carries a risk. If something bad occurs, both your portfolio and paycheck will be in danger. Conversely, if the company has a solid history and employees can buy shares at a discount, this could become a very lucrative opportunity for you.

Penny stocks are popular with many small time investors, but don’t overlook the potential value of blue-chip stocks that grow over the long term. Not only should you focus on companies that guarantee growth, but you should also make sure to place a couple major companies in your portfolio as well. Major, established companies have good track records and investing in them carries a very low risk.

Purchase large, popular stocks. These tried and true stocks are easy to move and carry less risk. You can then branch out a little, choosing stocks from midsize or small companies. Keep in mind that small start-ups could see fast growth, but also have a high risk of failure.

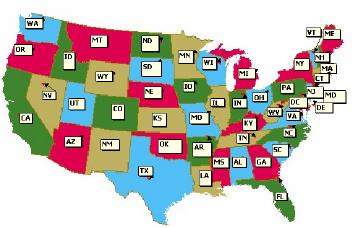

Find global stock value here